All Categories

Featured

There is no one-size-fits-all when it comes to life insurance coverage./ wp-end-tag > In your active life, financial independence can appear like a difficult objective.

Fewer companies are offering traditional pension strategies and several business have lowered or ceased their retirement strategies and your ability to depend exclusively on social safety and security is in question. Even if benefits haven't been minimized by the time you retire, social safety alone was never meant to be enough to pay for the way of living you desire and are worthy of.

/ wp-end-tag > As component of a sound monetary strategy, an indexed universal life insurance plan can assist

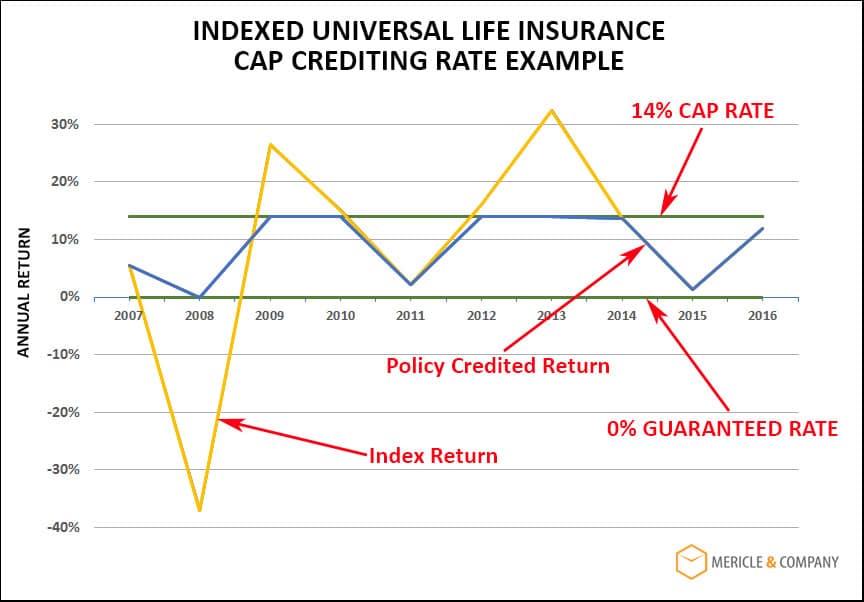

you take on whatever the future brings. Prior to dedicating to indexed global life insurance coverage, right here are some pros and disadvantages to consider. If you select an excellent indexed global life insurance policy plan, you may see your money value grow in value.

No Lapse Guarantee Universal Life Insurance

If you can access it beforehand, it may be valuable to factor it into your. Considering that indexed universal life insurance policy requires a specific degree of danger, insurance firms often tend to keep 6. This kind of strategy additionally uses (universal life policy calculator). It is still guaranteed, and you can change the face amount and cyclists over time7.

Commonly, the insurance policy company has a vested passion in performing better than the index11. These are all factors to be considered when picking the finest kind of life insurance coverage for you.

Using Iul For Retirement

Since this kind of policy is more complicated and has an investment component, it can commonly come with greater costs than other policies like whole life or term life insurance policy. If you don't assume indexed global life insurance policy is appropriate for you, here are some options to think about: Term life insurance is a momentary plan that usually uses coverage for 10 to 30 years.

When deciding whether indexed universal life insurance coverage is right for you, it is necessary to think about all your options. Whole life insurance coverage might be a better selection if you are searching for even more security and consistency. On the other hand, term life insurance might be a much better fit if you only require insurance coverage for a specific time period. Indexed universal life insurance policy is a sort of policy that uses much more control and adaptability, together with greater cash value growth possibility. While we do not provide indexed universal life insurance policy, we can give you with even more details about whole and term life insurance coverage policies. We advise discovering all your options and chatting with an Aflac representative to discover the ideal suitable for you and your household.

The remainder is contributed to the money value of the policy after fees are subtracted. The cash money value is attributed on a month-to-month or yearly basis with passion based on boosts in an equity index. While IUL insurance may show important to some, it is very important to comprehend just how it functions prior to purchasing a policy.

Latest Posts

How Does Index Universal Life Insurance Work

Universal Insurance Near Me

Group Universal Life Cash Accumulation Fund